Quick summary

Staking is when you lock up your cryptocurrency or tokens to secure the network or protocol. This earns you rewards. Proof of Stake blockchains needs staking to validate transactions. And protocols need staking to incentivize certain behaviors, like security or governance.

What is staking?

Staking is the process of locking up a cryptocurrency or token, usually for a minimum period. Doing this secures the network or protocol and can also give you governance rights. For doing this, you earn rewards. So you’re essentially rewarded for holding long-term.

There are three types of staking:

- Staking on a Proof of Stake (PoS) blockchain: On Proof of Stake blockchains like Ethereum 2.0, you stake cryptocurrency to become a validator. This lets you verify transactions on-chain to secure the network. For more on this, read our article on Proof of Stake.

- Staking tokens on a protocol: You can stake tokens to support the protocol like AAVE. This can create a safety net in the event of protocol failure, give governance rights, ensure long-term support, or a combination of the three.

- Staking liquidity pool tokens: You can earn boosted rewards by staking your liquidity pool tokens.

Why would you want to stake?

The main incentive for staking is the rewards you receive. The amount varies based on the protocol, the amount staked, and any incentives.

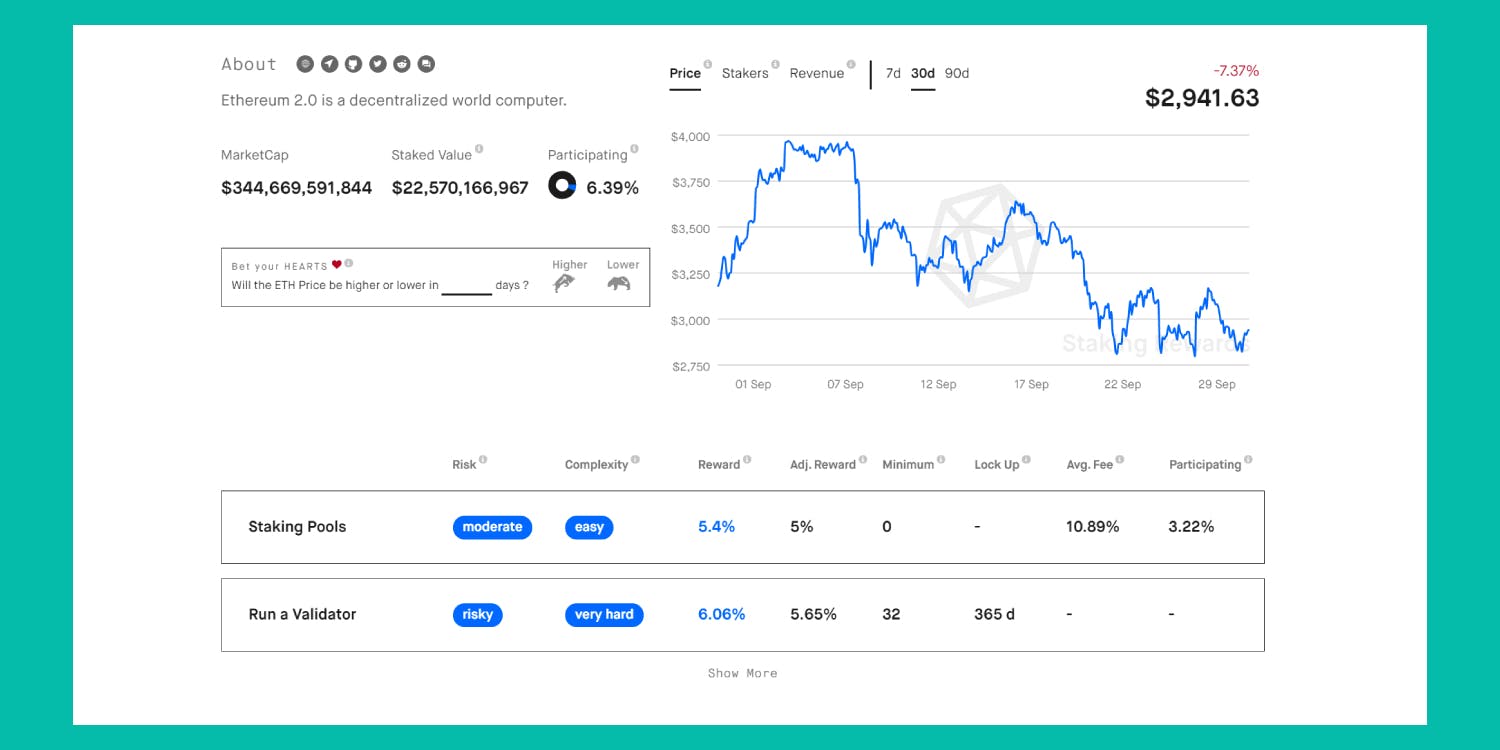

All this information is available on StakingRewards -- a website built to track staking rewards.

ETH 2.0 interface on StakingRewards

When you stake on protocols like Curve (CRV) and Sushi (Sushi), you receive a new token like veCRV and xSushi. These tokens give the holders the right to vote on any governance proposals. These proposals help shape the direction of the protocol. For example, deploying SushiSwap on Polygon with incentives to drive growth.

What are the risks of staking?

There’s always a slight risk with the code when you stake, like a bug or coding error.

Another risk comes with protocols like AAVE. When you stake AAVE, your tokens are used as a safety net to cover any losses from a ‘shortfall event’. A shortfall event is an unexpected loss of funds from an external event.

Staking liquidity pool tokens

When you provide liquidity in an automated market maker (AMM), you receive tokens representing their share of the pool. In some cases, these protocols offer incentives like a third token with trading fees. This happens to improve the liquidity of trading pairs. It also earns you greater rewards as you can sell this third token.

But claiming these rewards is expensive due to gas and inconvenient as rewards are manually claimed.

To improve this process, protocols like Harvest Finance and Convex automate this process. You stake your liquidity pool tokens and earn boosted rewards. This happens as your liquidity pool tokens become socialized with others. Any fees and incentives are automatically reinvested to increase your liquidity pool position. This is more efficient and saves on gas.

This does create another layer of risk as you’re moving your tokens to another protocol.

How can you stake with Argent?

In the Argent app, you can directly stake your ETH through Lido. All you need to do is go to the ‘invest’ section, tap on ‘Eth2 staking’, and make your deposit to earn rewards. It’s that simple.

If you want to learn more about Lido, read our blog post.

Further resources

Is custodial staking bad for Ethereum? An article by Bankless

Staking Economy Values: Keeping Rent-Seekers Out: An opinion piece on the Defiant

Ready to get started with DeFi?

Argent is a simple, secure, all in one wallet for investing in DeFi

Download ArgentRelated Articles

What is Ethereum 2.0?

An exciting upgrade to the Ethereum blockchain improving scalability, sustainability and security!

How do I start using DeFi?

DeFi is not a token, a company, or a stock to invest in. It's a whole new financial system.

The essential crypto and DeFi reading list

Our curated guide to the best learning resources on crypto, blockchain and DeFi