Quick summary

Proof of Stake is an alternative consensus mechanism that aims to solve the issues related to Proof of Work. Proof of Stake replaces miners with randomly selected validators who stake the native cryptocurrency to produce and approve blocks, receiving rewards based on their total stake.

If you’re new to cryptocurrency and blockchains, then we suggest you read our ‘What are blockchains?’ article before reading this.

How does Proof of Stake work?

Where Proof of Work uses miners to mine cryptocurrency, Proof of Stake uses validators. A validator is someone that ‘stakes’ the blockchain’s native cryptocurrency, like Ethereum, to lock them into the blockchain.

For a validator to produce and approve blocks for the blockchain, they are randomly selected to validate transactions. The more cryptocurrency staked, the higher your chances are of selection. If a validator acts irresponsibly or maliciously, they will lose a percentage of their stake through slashing penalties.

Advantages and disadvantages of Proof of Stake

Advantages

- Network alignment: Validators are economically aligned with the growth of the blockchain. Their chances of validating transactions is based on their stake. The more they stake, the higher the chance of getting selected and earning rewards.

- Consumer hardware validators: Validators run on basic hardware. This makes it accessible for people to secure the network.

- DAO staking providers: If you don’t have the cryptocurrency to run a validator, decentralized services like Lido allow you to stake any amount of cryptocurrency. Your cryptocurrency gets pooled together with others to run validators and is ran by the DAO.

Disadvantages

- Minimum cryptocurrency requirement: Validators need a minimum cryptocurrency stake. For Ethereum 2.0, this is 32 ETH, which is unaffordable for most people. And as the Ethereum network grows, the price of ETH, in theory, will continue to increase.

- Centralization: The more cryptocurrency you have, the more validators you can run. This can potentially give large holders disproportionate influence on the on-chain activity.

- Staking on a centralized exchange: To offer convenience, centralized exchanges like Coinbase offer staking services. But this centralizes the blockchain giving exchanges significant influence over validating transactions.

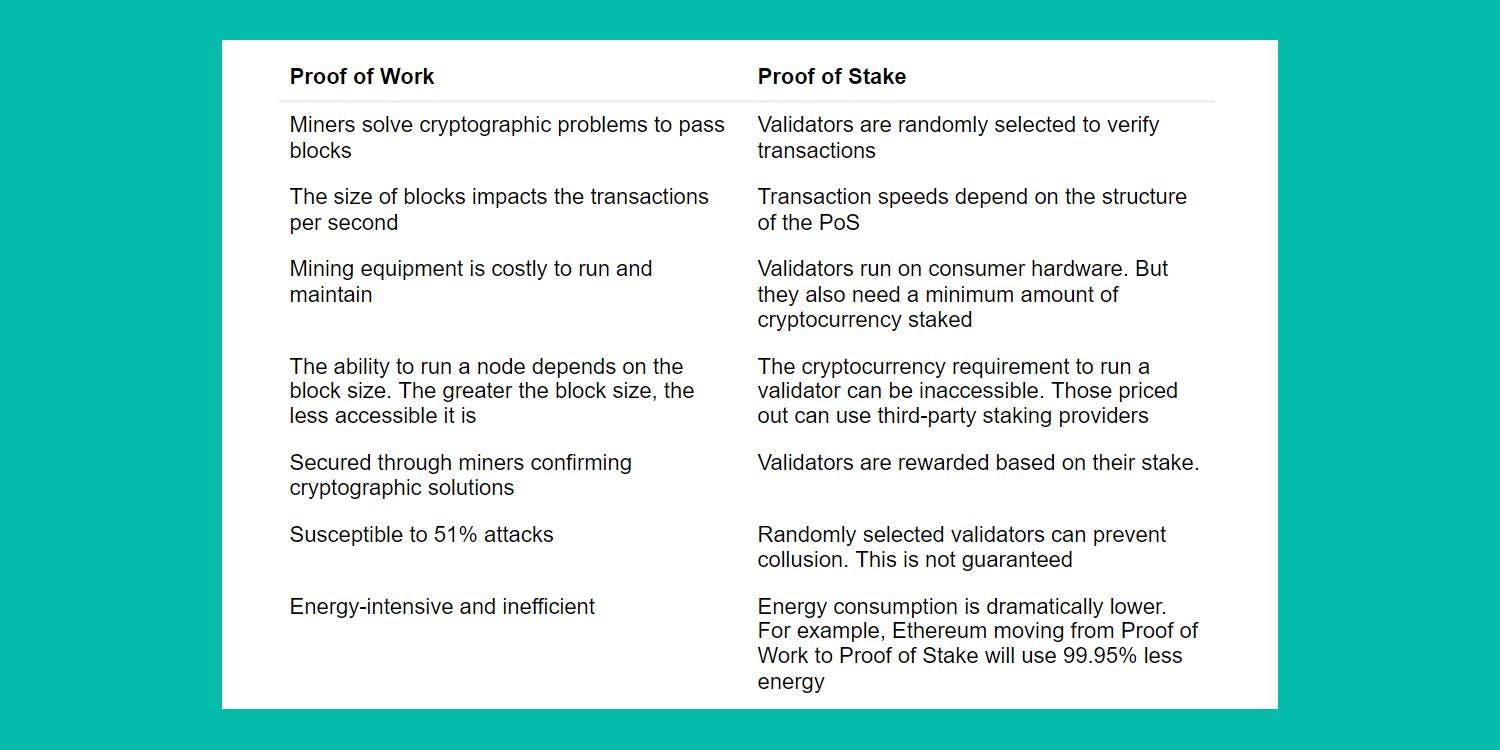

Comparing Proof of Stake with Proof of Work

To see how Proof of Stake compares with Proof of Work, we have created a table that compares the two consensus mechanisms.

If you want to read an in-depth comparison, then you can read this article by Rafael Solari.

Further resources

A visual explanation of Proof of Stake

A country’s worth of power, no more! A blog post on Proof of Stake and ETH 2.0

Vitalik Buterin discussing on the Bankless Podcast why Proof of Stake for ETH 2.0

Ready to get started with DeFi?

Argent is a simple, secure, all in one wallet for investing in DeFi

Download Argent