Quick summary

If you're wanting to provide liquidity, deciding what pool to deposit into is a tiresome task. And, if you’re already providing liquidity, tracking the returns and all your positions is time-consuming. Liquidity pool trackers make this process easy. Here are the 5 best!

What are liquidity pools?

Liquidity pools are the trading pairs on automated market makers (AMMs), creating a market. Users deposit two tokens of equal value -- for example, 50% DAI and 50% ETH into the DAI/ETH pool to add liquidity. And the more liquidity in the pool reduces slippage for the trading pair. Slippage is the difference between the expected price of the trade and the price when the trade gets executed.

Some AMMs allow users to deposit more than two tokens, such as Balancer.

The reward for providing liquidity is a percentage of the trading fees relative to your share of the pool. In some cases, AMMs will incentivize users with their governance token. For example, users of Balancer earn BAL with their percentage of trading fees. This creates even greater returns!

What are liquidity pool trackers?

A liquidity pool tracker will track the performance of your liquidity pool deposits. In some cases, a tracker can provide analytics. Or, they will show you liquidity pools with their return on investment (ROI). This is the estimated return for the year. Beware, this may change.

Best liquidity pool trackers

Let's go through the best liquidity pool trackers!

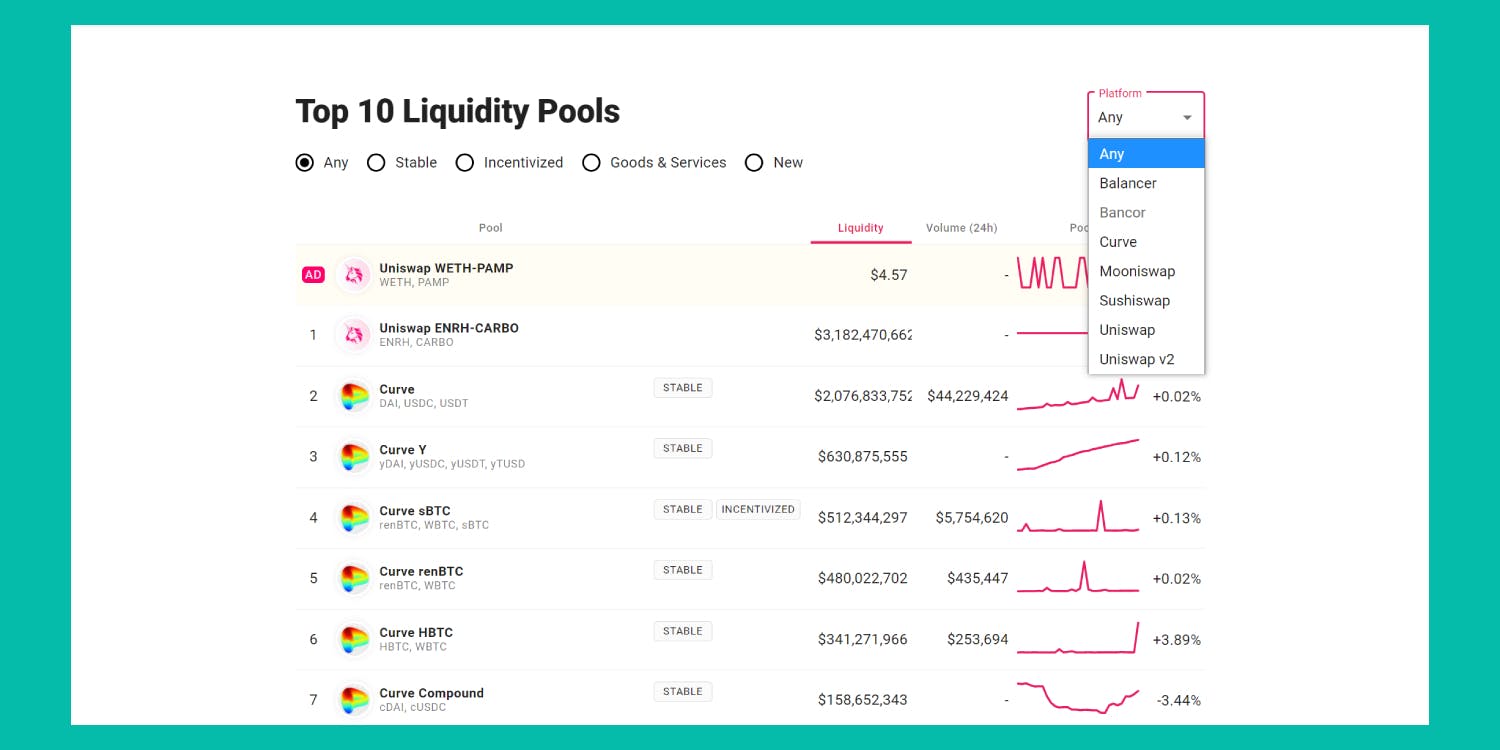

1. Pools.fyi

In Pools.yfi you can find the top liquidity pools across a range of AMMs with your liquidity positions and analytics. This includes 30-day returns and total liquidity in a liquidity pool.

If you’re curious about what liquidity pools to deposit in or a specific AMM, Pools.yfi does that!

Credit: Pools.yfi

Website: pools.yfi

Twitter Account: Has no Twitter account.

2.Croco Finance

With Croco Finance you read any ETH address to view strategies. This is possible as the data is all on-chain. You can simulate current and past positions with other strategies to see if you would have performed better by holding the tokens instead. A handy tool to have access to when figuring out how best to use your crypto!

Credit: Croco Finance dashboard

Website: croco.finance

Twitter Account: @CrocoFinance

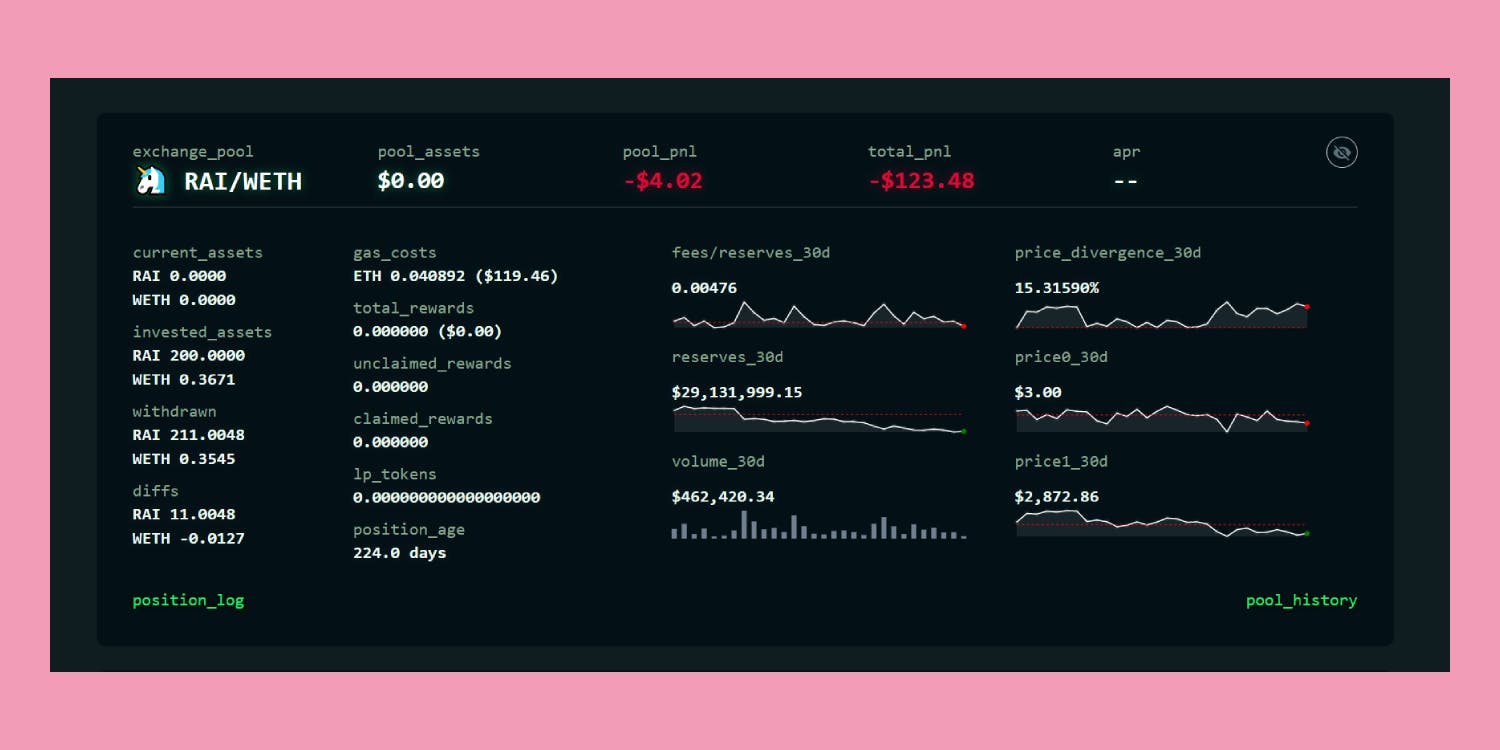

3. Revert Finance

Revert Finance has the most unique user interface out of all the liquidity pool trackers on this list. Revert Finance lets you track the performance of any past or current liquidity pools. They also provide a breakdown of all your positions.

Using the pool_history_ function shows the historic performance of the pool. This gives you actionable analytics for future deposits.

Credit: Revert Finance dashboard of an exited LP position

Website: revert.finance

Twitter Account: @revertfinance

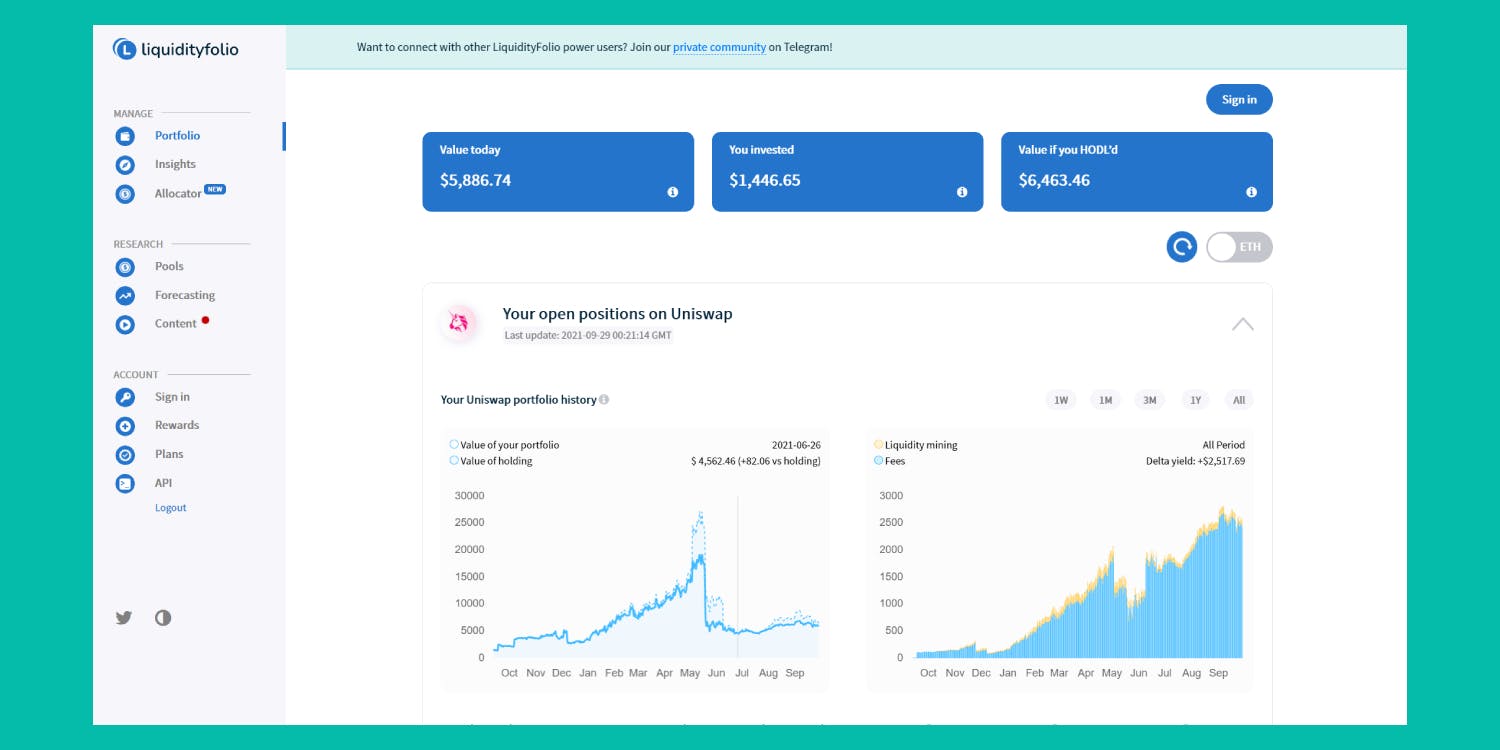

4. Liquidityfolio

Liquidityfolio helps liquidity providers optimize their yield. If you use Liquidityfolio, you can find a breakdown of your liquidity positions across AMMs. This includes how much you invested and any return.

Liquidityfolio also has excellent educational videos on their youtube channel on DeFi. If you're new to liquidity pools, they'll be a great help!

Credit: Liquidityfolio demo page

Website:liquidityfolio com

Twitter Account: @Federiconitidi

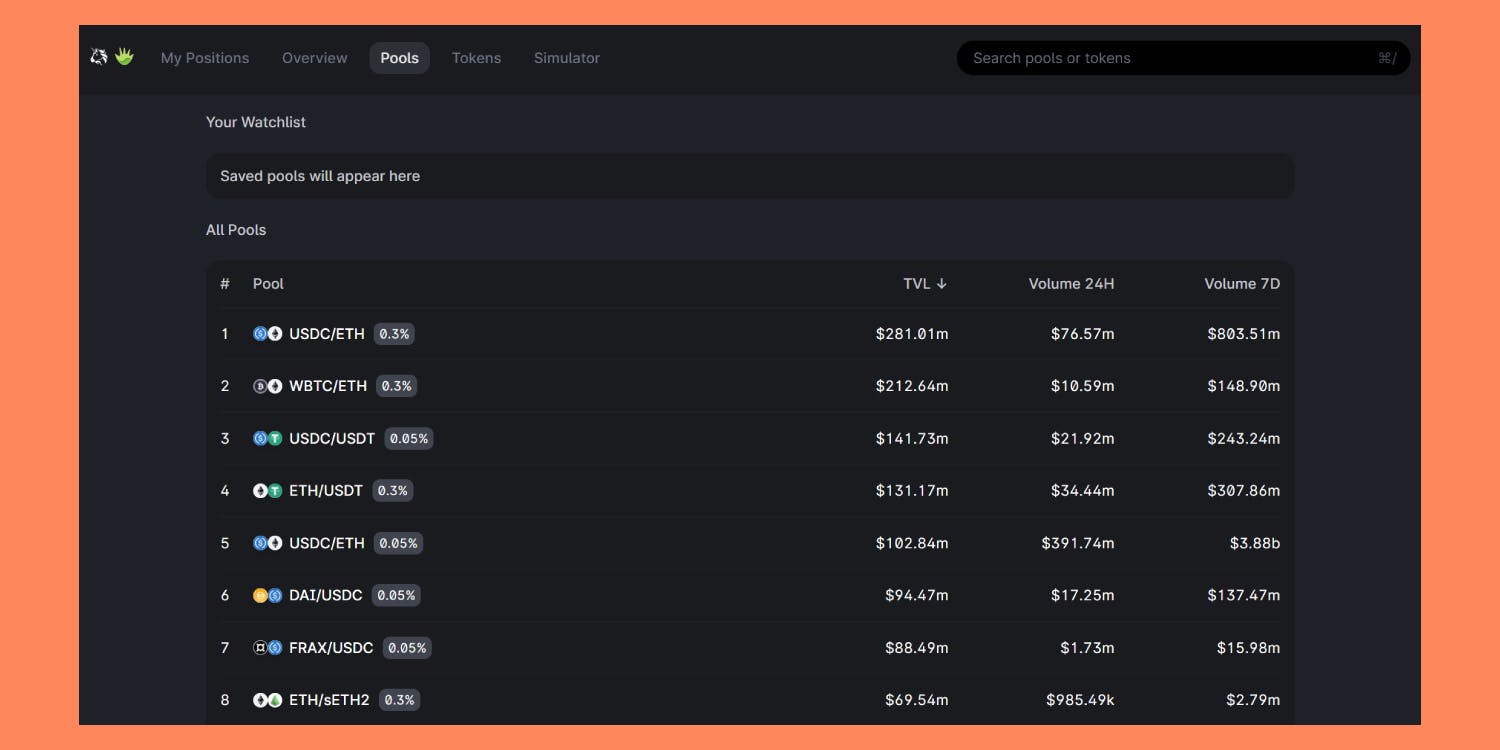

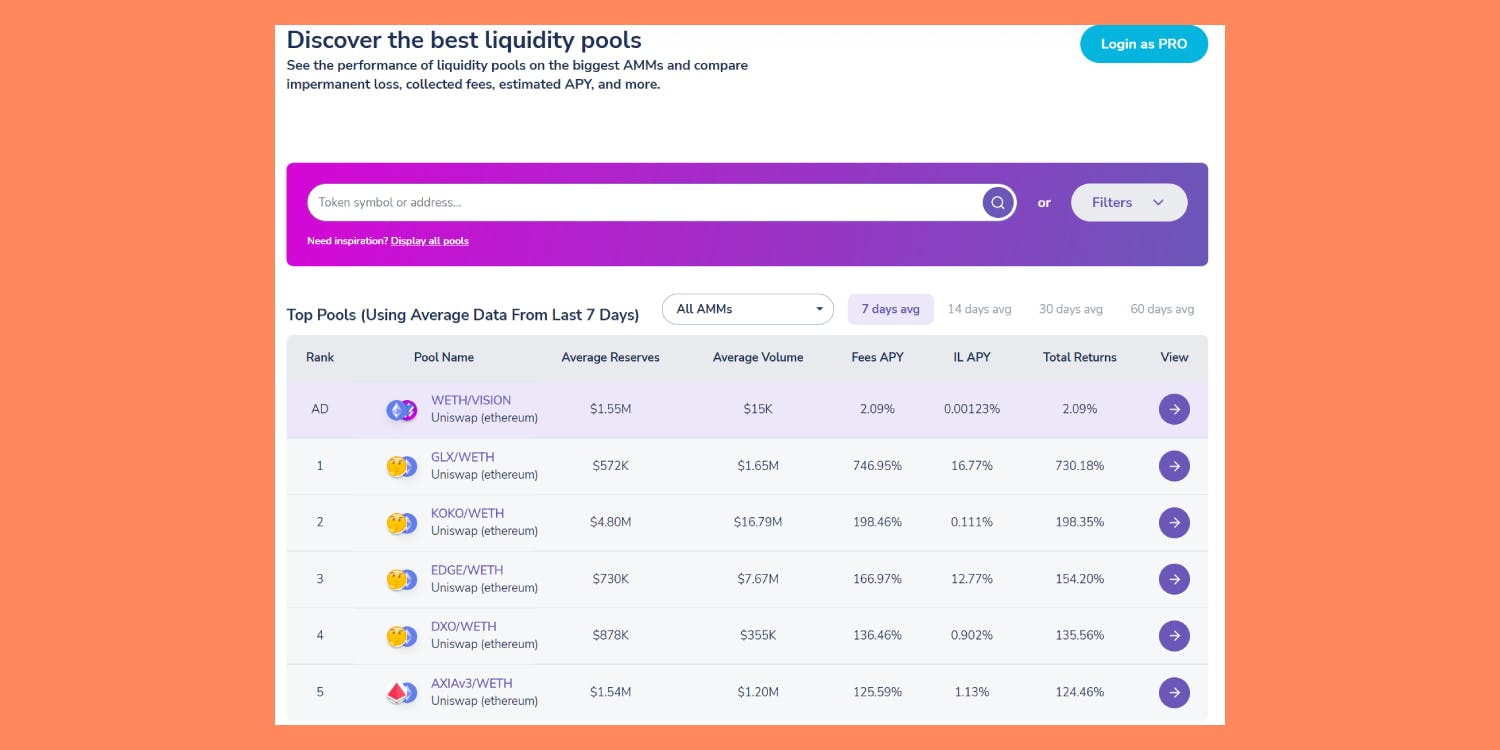

5. APY.Vision

APY.Vision offers a two-tiered dashboard to manage your liquidity pools. The basic tier shows available liquidity pools across a range of AMMs, tracking any impermanent loss and your ROI.

The premium version unlocks a professional suite of tools to improve your experience. Some of these tools are the ROI with any yield farming rewards and real-time market price quotes.

Credit: APY.Vision

Website: apy.vision

Twitter Account: @ApyVision

Use Argent when using liquidity pools

Argent is the most secure cryptocurrency wallet available. When you’re using DeFi, make sure your wallet doesn’t put you at risk.

Further resources

A visualization of how liquidity pools work by Finematics

DeFi Yield Farming: Why It’s All the Rage But Risky - an UnChained Podcast

Aaron Lammer on Yield Farming and Trading in the World of DeFi - an Odd Lots Podcast

Ready to get started with DeFi?

Argent is a simple, secure, all in one wallet for investing in DeFi

Download ArgentRelated Articles

What is “DeFi”?

A simple guide to the latest revolution in finance

How to track DeFi token prices

Our favorite DeFi price and Ethereum Gas trackers, plus portfolio management tools.

What are the benefits of DeFi?

The traditional finance model that we are familiar with is build on centralised authorities (such as banks) to process transactions and act as intermediaries. With DeFi, there are no middlemen. It's finance for the people, by the people.