Quick summary

Decentralized Finance (DeFi) is full of risks like hacks and smart contract exploits. To protect against threats like this and others, you can get insurance! Don't know where to go? You're in luck as this article lists the best insurance decentralized applications (Dapps).

Disclaimer: This article is for educational purposes and is not financial advice.

What is DeFi insurance?

Traditional insurance like life or housing is a way to protect yourself in the event of a worst-case scenario.

DeFi insurance is no different.

In DeFi, protocols can fail, smart contracts get exploited, and there are hacks! To protect against these risks, you can get insurance.

When you’re farming that yield, experimenting with that new protocol, or risking a significant amount of your portfolio -- it may be wise to get some crypto-insurance!

Now you know what DeFi insurance is, where can you get it?

What options are available?

We’ve created a list of the 3 most popular DeFi insurance providers. In no particular order, they are:

1. Nexus Mutual

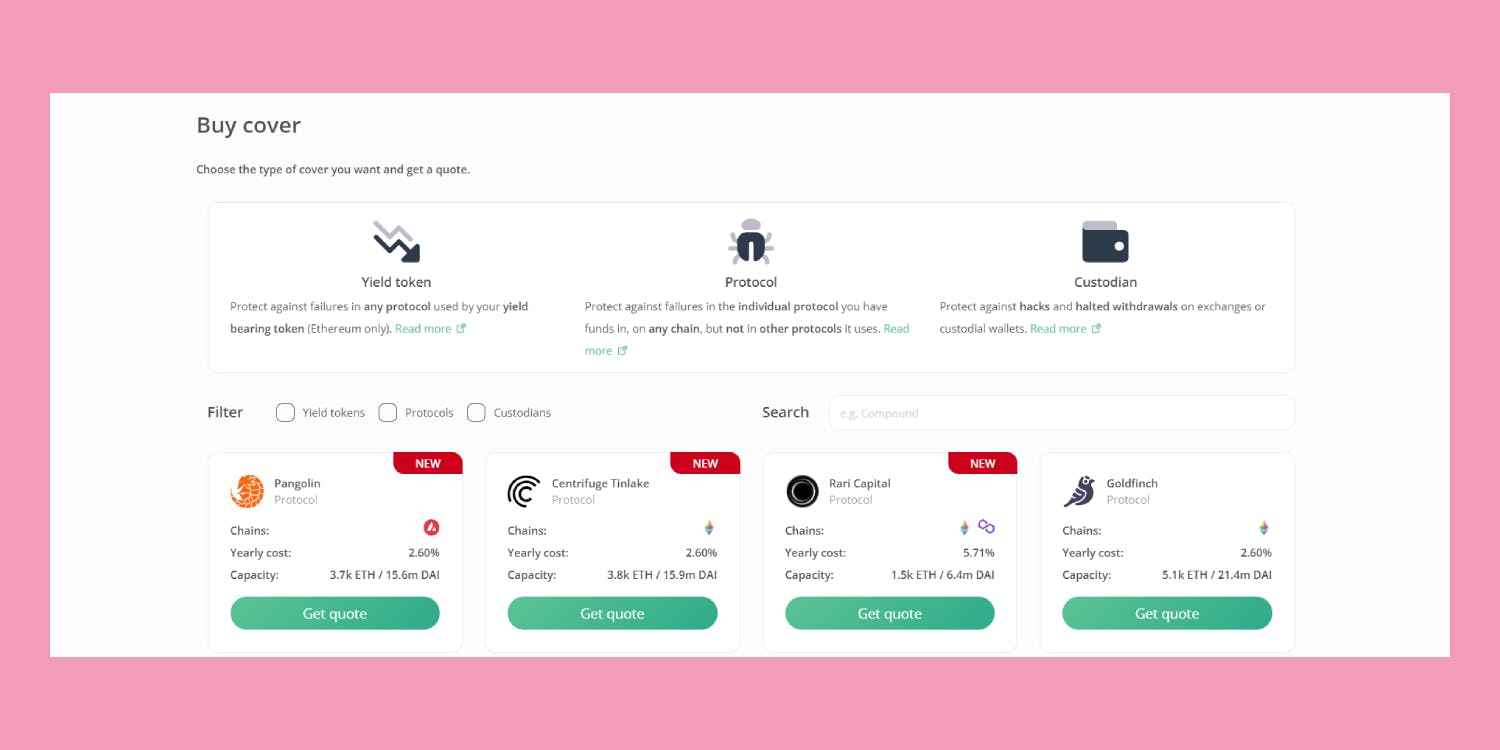

We start with Nexus Mutual, the leading DeFi insurance protocol. Nexus Mutual offers peer-to-peer insurance for major cross-chain smart contract protocols. This protects against any bugs or exploits in the code. Nexus Mutual also provides insurance against Centralized Exchange hacks!

To get insurance, you choose the protocol you want protection in and the amount you want to be covered. The amount covered can be valued in either ETH or DAI for a period of 30, 90, or 365 days. To pay for protection, you can use ETH or NXM, the native governance token for Nexus Mutual.

If the worst-case scenario happens, and you need to make a claim, then Nexus Mutual members will decide if the claim is valid. Sounds scary! But Nexus Mutual has already paid out for claims in the past, like the bZx bug!

Website: Nexus Mutual | A decentralized alternative to insurance

Twitter Account: @NexusMutual

2. Risk Harbor

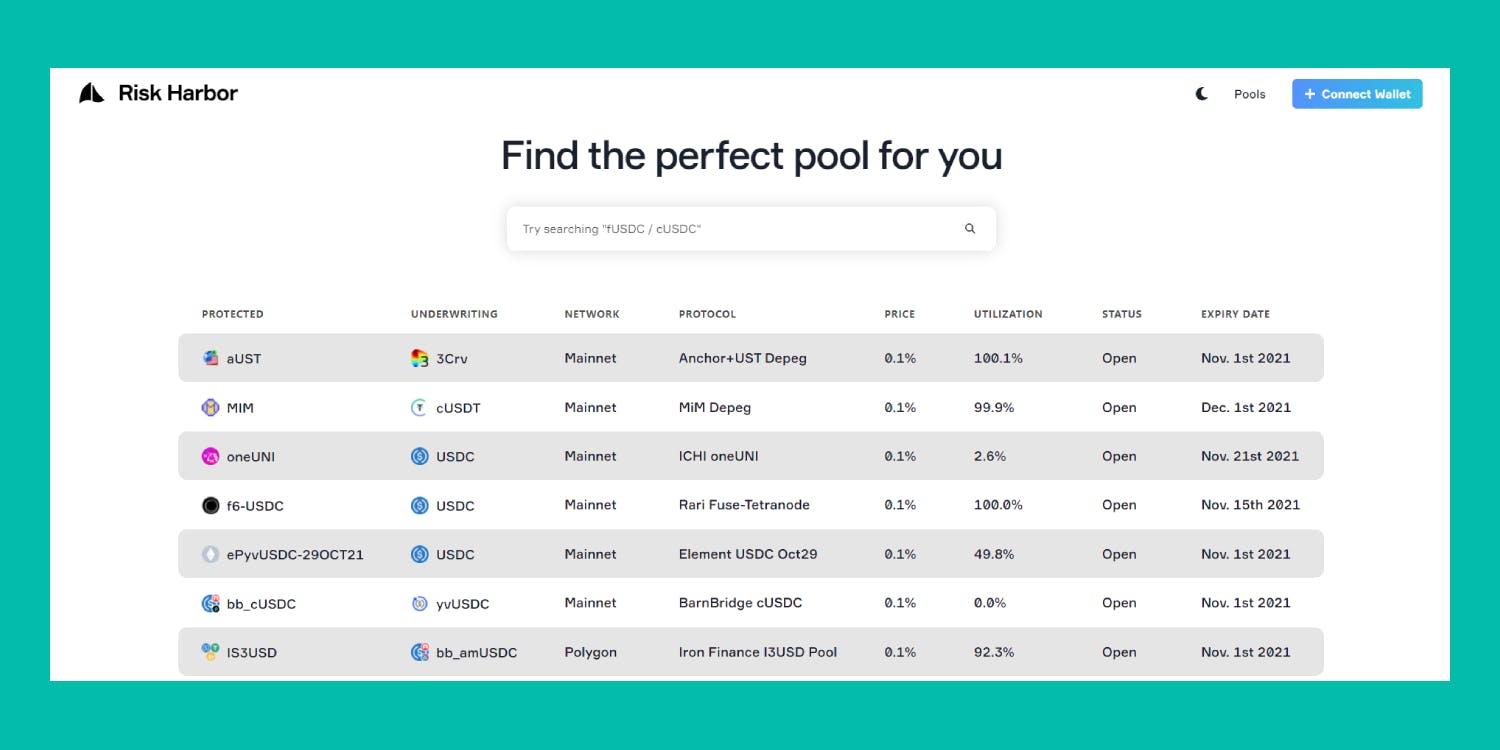

Risk Harbor is the newest protocol on this list. It offers protection for various crypto-backed stablecoins like MIM and Tetranodes Pool 6 on Rari Capital, with this list expected to expand. Risk Harbor is appealing to newer and trending DeFi protocols like Abracadabra Money, ensuring that you have protection for these dapps.

To get insurance, choose the pool that is right for you and select how much you want to be insured. Alternatively, you can help underwrite the insurance by providing capital that earns yield but your capital will get used if the stablecoin loses its peg, or there is a hack. In the event that this happens, and you have taken out protection, you can easily make a claim by selecting 'claim' and then putting the amount you had protected.

Website: Risk Harbor App

Twitter Account: @riskharbor

3. Unslashed Finance

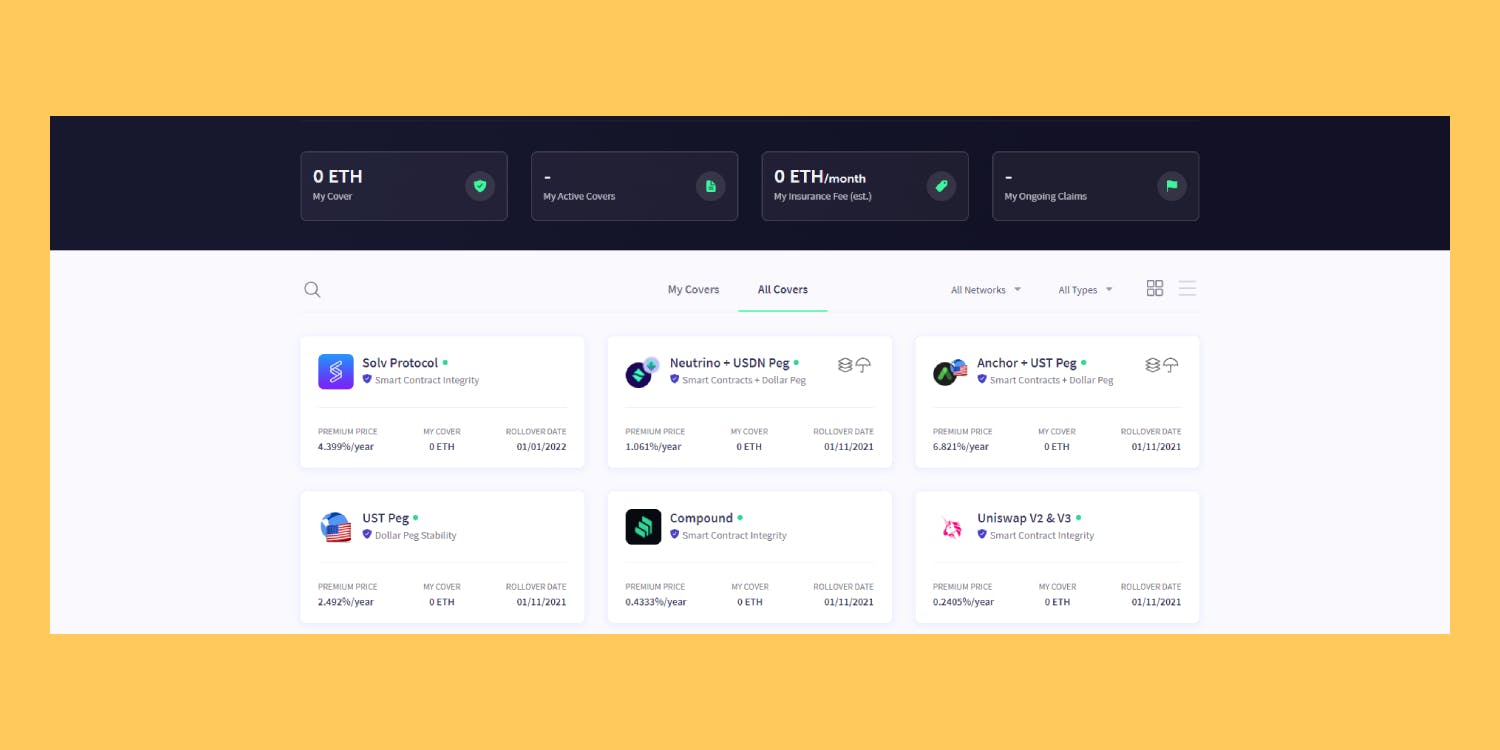

Unslashed Finance offers protection for a range of DeFi risks and other risks, like centralized exchange hacks. You can choose what you need insurance for and, for how much, paying the premium based on the risks. This premium goes to those supplying liquidity for the Dapp.

Unslashed finance has a feature called ‘buckets’ for those supplying liquidity. Buckets combine many pools into one so that the risks of providing capital get reduced.

Website: Unslashed Finance

Twitter Account: @UnslashedF

Further resources

New Crypto Insurance Platform Doubles Down On DeFi Risk

DeFi Insurance and how Nexus Mutual Works

Insurace -Decentralized Insurance for Crypto Risk

How to Purchase DeFi Coverage and Earn COVER (Cover Protocol)

Cryptocurrency Insurance Could Be a Big Industry in the Future

Ready to get started with DeFi?

Argent is a simple, secure, all in one wallet for investing in DeFi

Download ArgentRelated Articles

What is “DeFi”?

A simple guide to the latest revolution in finance

5 of the best liquidity pool trackers

Managing liquidity pools is usually a tiresome task. But liquidity pool trackers make this easy!

The essential crypto and DeFi reading list

Our curated guide to the best learning resources on crypto, blockchain and DeFi